Safe Gen AI solutions that help customers get the most from their insurance

Grow your insurance program with AI agents that support your customers through the quote and buy journey.

"

At Open, we’re bringing GenAI into the world of insurance, to help customers navigate it with clarity and confidence. Our first step is Insurance Companion: the fastest, safest way to offer AI-powered insurance advice to customers.

Thomas Walker, GTM Director, Open Agentic

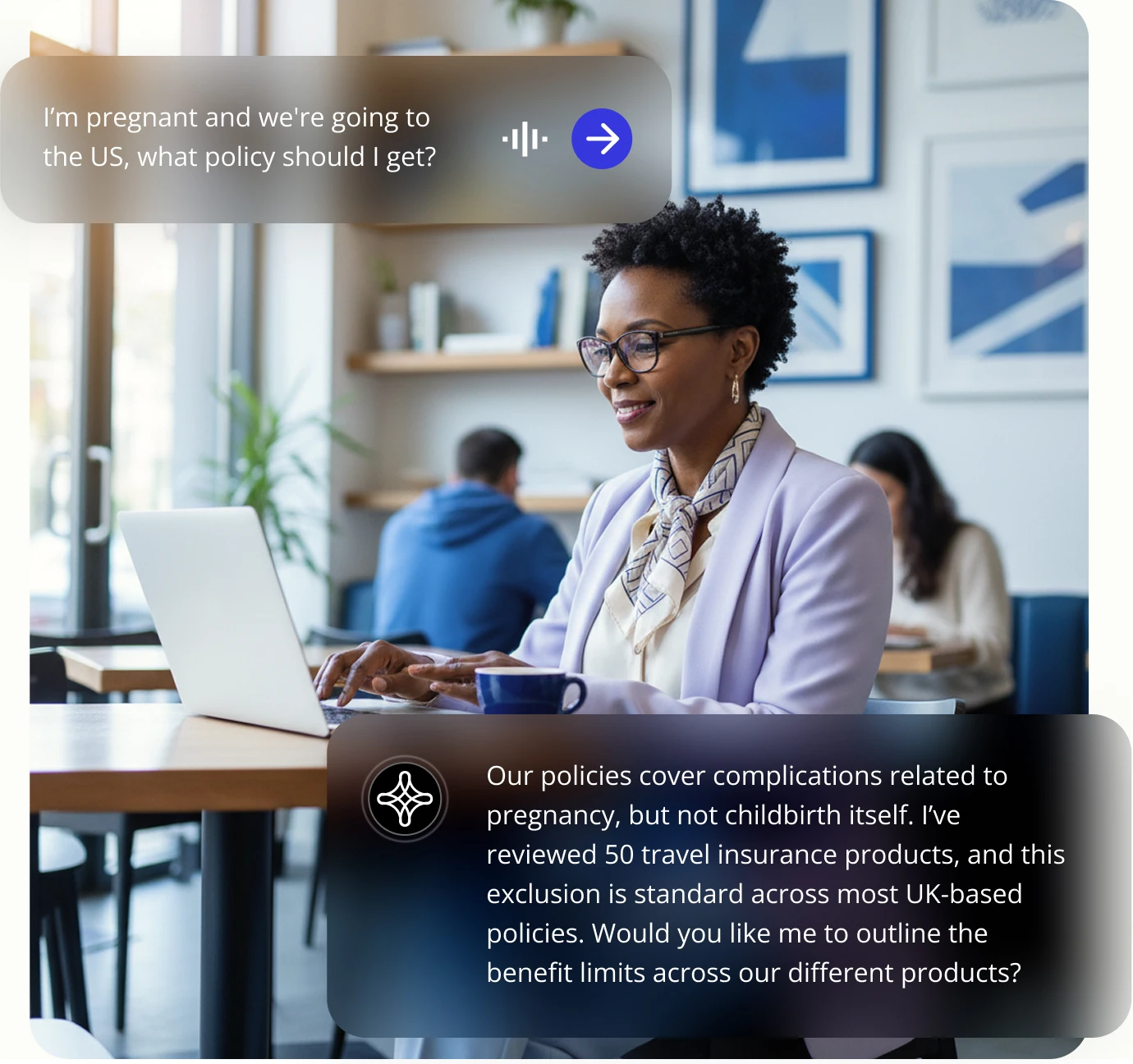

Insurance Companion: your smart, always-on insurance advisor

Insurance Companion is purpose-built to guide your customers through the quote and buy journey seamlessly, confidently, and in real time.

Designed for insurers and digital intermediaries, it delivers compliant, context-aware answers and product guidance within your existing digital experience.

Insurance Companion increases sales

Today, customers leave your site to find answers to their questions. With Insurance Companion, they stay with you and feel supported, informed, and ready to buy.

- Reduce drop-off in your sales funnel

- Increase customer trust and loyalty

- Accelerate digital channel adoption

GenAI, purpose-built for insurance advice

Continuously trained for market-specific compliance

Our proprietary Open General Insurance Intelligence (OGII) models are trained to meet regulatory requirements in the UK, Australia, and the US. Each is tailored to local rules and market standards, ensuring safe, compliant insurance advice, by design.

Built for the agentic economy, the OGII models enable AI agents and digital platforms to operate confidently in multiple jurisdictions, with FCA and ASIC compliance today, and support for US state-based regulation launching next year.

Safety by design

We’ve built a system that puts safety first. We measure performance across four key dimensions: Compliance, Retrieval Accuracy, Explainability, and Hallucination Management.

Unrivalled compliance risk management

Compliance Risk Index™ is Open’s proprietary benchmark for measuring the performance of agents and models against regulatory requirements and controls. A lower index reflects a lower incidence of potential issues per 1,000 conversations. The Compliance Risk Index™ and our continual monitoring ensure Open’s AI-driven insurance experiences are fair, transparent, and compliant by design.

Accurate retrieval, even at scale

Typically, information retrieval pipelines start to fail when there are large numbers of complex documents. In applications where an agent may need to access and compare information from hundreds of documents, this becomes a problem. Using cutting-edge approaches, OGII models are able to retrieve information from large collections of documents, such as policy wordings, without loss of accuracy. With these approaches, we significantly outperform mainstream models.

Breakthrough levels of auditability and explainability

Insurance Companion moves beyond the black box approach used by most AI providers. Every output of an OGII model is auditable and explainable, allowing each response to be traced back to the evidence and reasoning that produced it.

Using mechanistic interpretability, the same state-of-the-art techniques applied in healthcare AI, we can identify which parts of the model were activated during generation, and link those activations to verified source material. This creates a transparent chain of reasoning for every interaction, ensuring each response in each conversation can be inspected, validated, and trusted.

Systematic hallucination detection and nonsense content blocker

One of the biggest concerns when deploying LLMs is the risk that hallucinations will result in customers being provided incorrect information. All OGII models are deployed with automatic hallucination detection, so incorrect information is systematically detected and blocked by our guardrails, and never published.

Built by insurance experts

Open’s GenAI technology is developed by a team of insurance specialists and leading machine learning and AI engineers combining deep domain knowledge with cutting-edge technical capability.

Jonathan Buck

Jason Wilby

Rishin Patel

Thomas Walker

Sarith Fernando

Sam Hoppe

Bayne Carpenter

Romain Gregoire

Insurance Companion is your out-of-the-box AI solution

- Fully-licenced: Deploy with confidence knowing that all advice is provided under Open’s licence.

- Easy to embed: With only a few lines of code.

- Multi-modal: Customers can engage through messaging, voice or both.

- Customisable: Match your brand's personality and tone of voice perfectly.

- InfoSec: Fully auditable and built to Open’s enterprise-grade security standards.

Learning from the Open Agentic studio

Designing and building a safety harness for our insurance LLMs

We're building Open General Insurance Intelligence – and not using closed source models